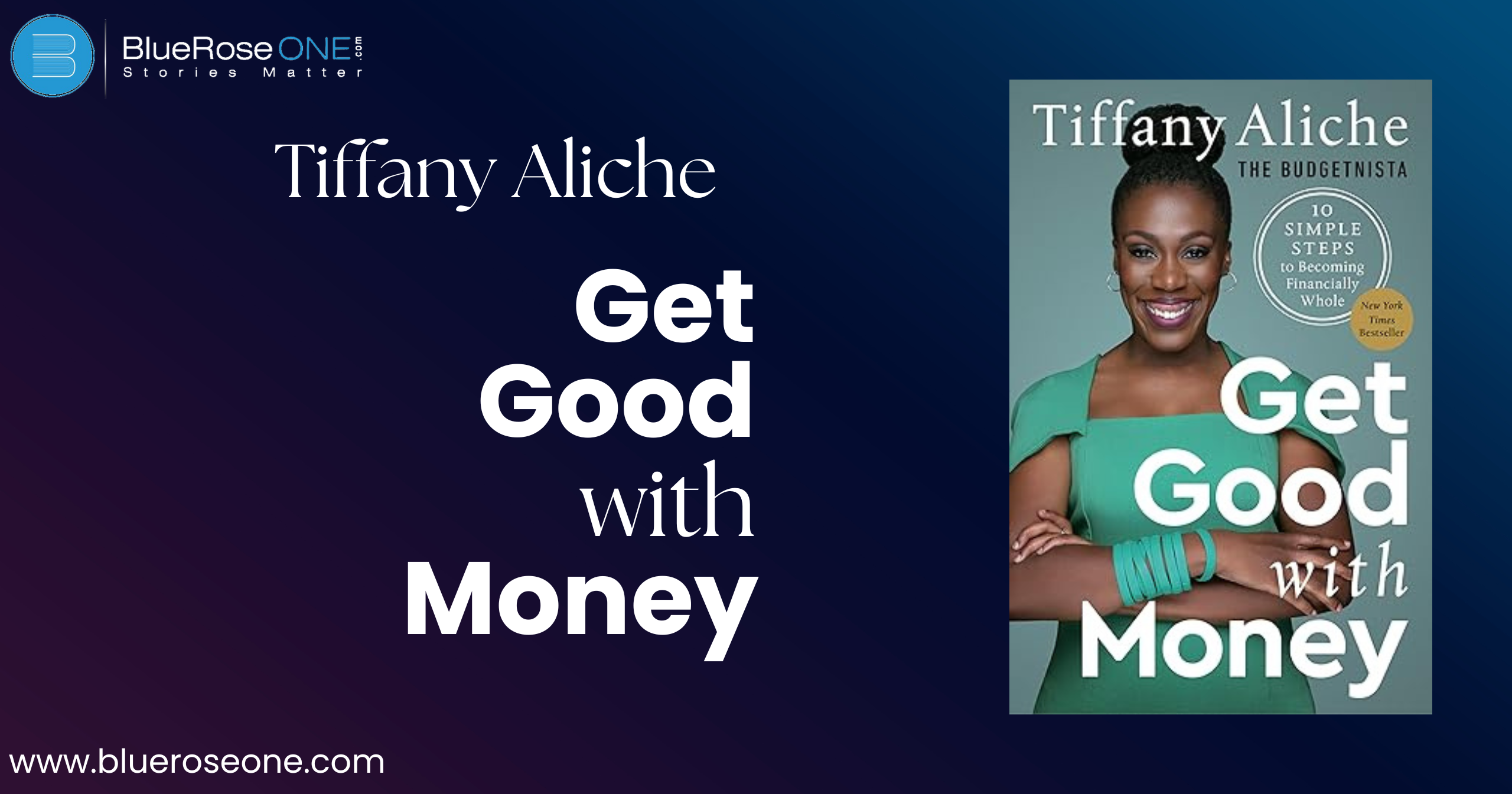

Do you want to better your finances but aren’t sure where to start? Tiffany Aliche’s Get Good with Money is a practical and easy-to-follow guide that will help you develop a strong financial foundation. Whether you’re battling with debt, saving for the future, or simply wanting to take charge of your finances, this book breaks it all down into simple, doable steps.

In this review and summary, we’ll discuss what makes Get Good with Money a must-read, go over its important lessons, and explain how it can help you achieve long-term financial stability.

What is Get Good with Money About?

Tiffany Aliche, better known as “The Budgetnista,” is the author of the personal finance book Get Good with Money. She is a former preschool teacher turned financial educator who has impacted millions of people through her workshops, courses, and online platforms. In this book, she presents a 10-step plan to help readers attain financial wholeness—a balanced, secure, and long-term approach to money management.

Unlike many money publications that focus solely on cutting spending or investing, Get Good with Money takes a comprehensive approach. It covers everything from budgeting and saving to insurance, estate planning, and boosting your earnings.

You may also like: Top 10 Must-Read Amitav Ghosh Books for Every Literature Lover

10 Steps to Financial Wholeness: A Quick Summary

One of the strongest features of Get Good with Money is the 10-step plan Tiffany calls the “Journey to Financial Wholeness.” Here’s a brief overview:

- Budgeting – Learn how to make a realistic budget that aligns with your goals.

- Saving – Build a savings strategy for emergencies and future goals.

- Debt – Create a plan to eliminate debt without sacrificing your lifestyle.

- Credit – Understand and improve your credit score for long-term financial health.

- Learning to Earn – Focus on growing your income and negotiating better pay.

- Investing – Learn the basics of investing and how to start with little money.

- Insurance – Protect yourself and your assets with the right coverage.

- Net Worth – Track your financial progress by calculating and increasing your net worth.

- Estate Planning – Understand the importance of wills and other legal documents.

- Financial Team – Build a support system of professionals and trusted advisors.

Each step comes with practical exercises, tools, and real-life examples that make the concepts easy to understand and apply.

You may also read: The god of the woods a Novel by Liz Moore: Book summary

Why Get Good with Money Stands Out

Many personal finance books offer advice, but few are as accessible and empowering as Get Good with Money. Tiffany Aliche writes in a friendly and encouraging tone that makes even the most intimidating topics feel manageable.

Here’s why this book is different:

Real-life approach: Tiffany shares her own journey from being in debt to becoming financially independent.

Simple language: Perfect for beginners who feel overwhelmed by financial jargon.

Diverse and inclusive: The book speaks to a wide range of readers, especially women and people of color who are often overlooked in the finance space.

Actionable advice: Each chapter includes clear steps, worksheets, and tips you can start using immediately.

You may also like: Scion of Ikshvaku by Amish Tripathi: Book Review

Who Should Read Get Good with Money?

This book is ideal for:

- Beginners who want to learn how to manage their finances

- People in debt looking for a way out

- Anyone who wants a clear and comprehensive plan to achieve financial security

- Readers looking for inspiration and real-life financial transformation stories

If you’re ready to get good with money, this book will give you the tools and motivation to start that journey.

You may also like: The Rise of Shakti by Megha Dinesh: Book Review

Final Thoughts: Is Get Good with Money Worth Reading?

Absolutely. Get Good with Money is more than simply a financial how-to book; it’s a road map for a better existence. Tiffany Aliche brings down complicated ideas into simple stages, demonstrating that financial freedom is possible regardless of your current situation.

If you’re tired of feeling bothered about money and want to make long-term improvements, Get Good with Money is the place to start.